Recent News

Florida Property Appraisers to Mail 2025 Proposed Property Tax Notices by August 22

The Florida Property Appraisers have either mailed or are planning to mail all proposed property tax notices to property owners by Friday, August 22. These notices provide key information regarding property assessments and proposed tax amounts for the upcoming year. Property owners are encouraged to review their notices carefully and reach out with any questions or concerns.

2024 July 1st Estimates of Taxable Values for Miami-Dade County

The Miami-Dade Property Appraiser, Pedro J. Garcia, has released the 2024 July 1st Estimates of Taxable Values for Miami-Dade County to the Taxing Authorities showing modest growth in the real estate market. The countywide estimated taxable value for 2024 is $471,525,736,521, a 10.7% increase from 2023 (including new construction).

Click here to view overall preliminary values for Miami-Dade for 2024.

We are in the process of reviewing the preliminary 2024 assessments for potential appeals. If you would like us to review your assessment, please contact us at (305) 787-3255 or by e-mail at propertytax@flpts.com.

Other News

The 2023 Ad Valorem property tax appeals have now concluded and any pending refunds should have been issued. If you would like an update on the status of your appeal, please contact us at your earliest convenience.

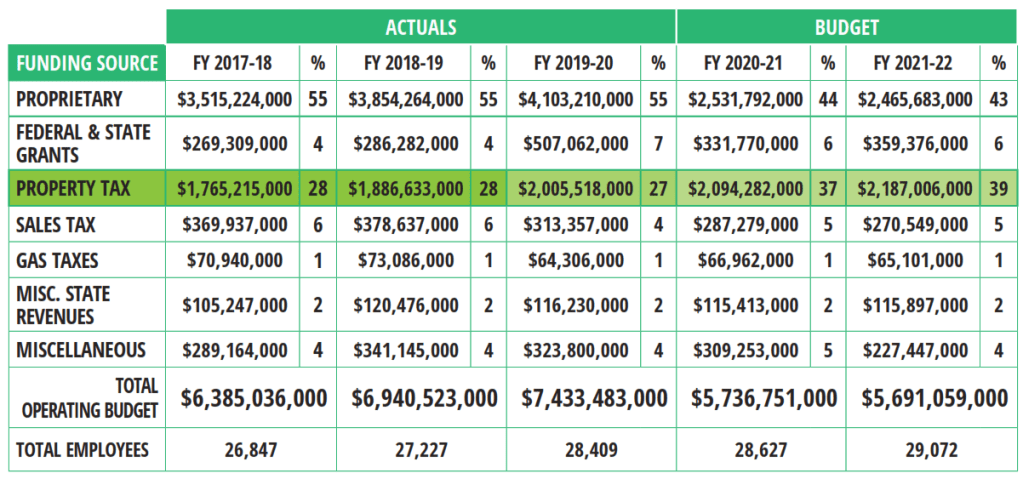

Last year, property taxes accounted for more than 35% of the county budget. There are approximately one million folios in Miami-Dade county and 800,000 folios in Broward county. These counties use mass appraisal techniques to determine an assessment for your property. Using mass appraisal, it increases the likelihood of an incorrect property assessment, yet very few property owners contest their assessment. If you believe your property is over assessed, now is the time to allow our team of professionals with over 15 years of experience to get your assessment corrected. If we are successful, it will reduce your property tax liability, resulting in a refund or a corrected tax bill.